Highlight

Successful together – our valantic Team.

Meet the people who bring passion and accountability to driving success at valantic.

Get to know usMunich, May 22, 2023: The digital solutions, consulting, and software company valantic has been asking SAP experts in German-speaking Europe every year since 2018 about the state of affairs regarding S/4HANA migration, their investment intentions, preferred technologies, and business opportunities. Comparison of the survey results year over year makes it possible to identify longterm trends and to assess developments.

Migration to SAP S/4HANA remains a strategic topic for SAP user companies in German-speaking Europe. A good fifth (21%) have already completed the migration process and are working productively with S/4HANA. However, three-quarters of companies still have the digital transformation to SAP’s future platform ahead of them, and the pace of migration, as shown by year-on-year comparisons, has declined slightly. Geopolitically and financially, many companies have had a few difficult years, which we believe may also play a role in the current decline in enthusiasm.

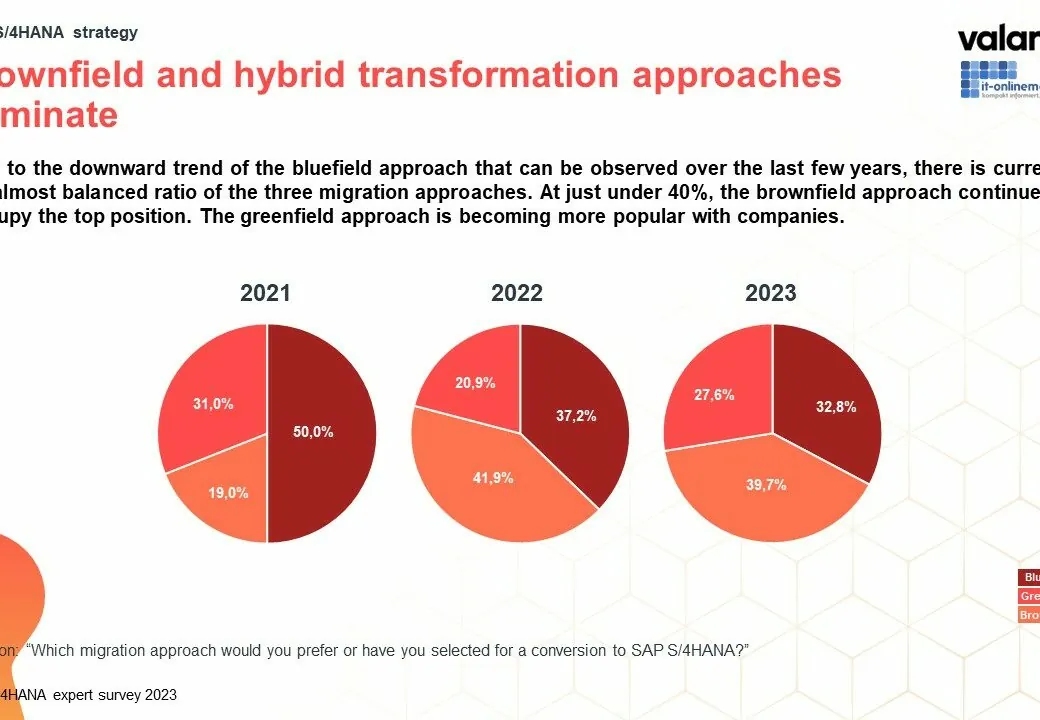

The majority of companies (39.7%) prefer brownfield approaches in various forms; that is, initially a technical migration to S/4HANA with slight to more pronounced improvement and optimization initiatives. However, the greenfield approach is also enjoying a significant increase in popularity (27.6%), after a small decline last year. With greenfield, companies are taking the opportunity to test and optimize their processes and solution architecture as part of the migration. Greenfield is more complex, but the result, especially with older SAP solutions, brings clear business benefits.

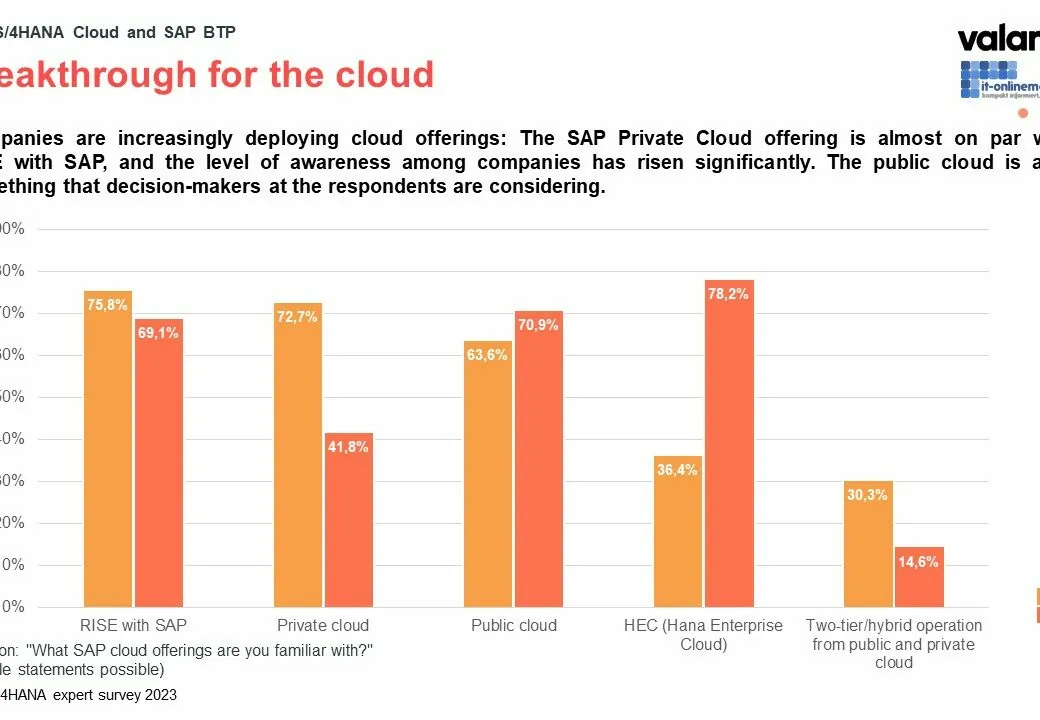

The “RISE with SAP” cloud initiative has gained considerable recognition, from 69.1% last year to 75.8% in 2023. However, SAP’s private cloud offering has also made a giant leap forward, from 41.8% last year to 72.7% this year. At least in terms of awareness. The skepticism about the cloud deployment model is diminishing noticeably for the first time this year.

Companies in German-speaking Europe do not seem to be completely aware of the capabilities of the SAP Business Technology Platform (BTP). Nearly half of the survey participants are using BTP (34%) or are busy with the implementation (13%); the other half have so far refrained from touching it. The main reason (64%) is: We have not done enough work on the SAP BTP yet. Also, estimated high costs prevent nearly 18% of survey participants from implementing the SAP BTP.

Compared to previous years, the finance & controlling business area, the automation leader in 2022, continues to lose ground in relative terms (from 87.2% in 2022 to 69.8% in 2023). By contrast, projects in the logistics sector, where the second highest automation potential is seen, have increased significantly (from 46.8% in 2022 to 67.4% in 2023). Purchasing and sales remain largely unchanged. valantic’s consultants sum things up like this: Automation no longer only takes place in the “obvious” and supposedly simpler process steps, but also is also moving into more complex areas as a relevant component of process solution architectures.

Interest in conversational AI/chatbots has also increased significantly compared to the previous year; it currently stands at just under 30%. Following the megahype that ChatGPT has triggered worldwide since November of last year, companies in German-speaking Europe are now beginning to evaluate robust business scenarios for the use of language models and are obviously succeeding with these.

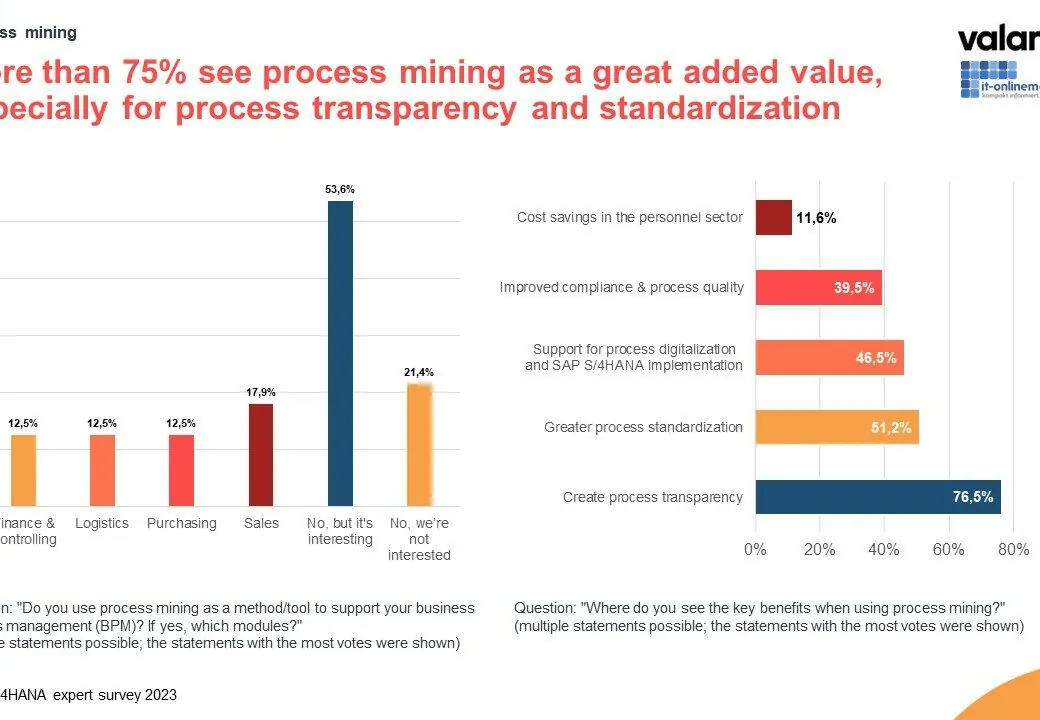

Related to this, more than 75% of survey participants see process mining as a great added value for their company and they mean, in particular, greater process transparency, standardization, and process digitalization. With process mining technology, the companies’ experts gain an overview of the sometimes very extensive process landscapes and then initiate improvement measures. The focus is currently on the sales, finance & controlling, logistics, and purchasing business areas. Only a small minority of 21% are not at all interested in technology.

The platform and tools of SAP’s own Signavio (38.1%) are used in process mining projects. Companies are also working with the Munich-based process mining specialist Celonis *28.6%) and the process automation company UiPath to digitalize and optimize their business processes and achieve time and efficiency gains along the process and value chain.

Rüdiger Hoffmann, Managing Director of valantic ERP Consulting: “The most important key benefits of process mining are process transparency and process digitalization. The value of process mining in the transformation is not yet sufficiently taken into account. Process mining must be considered in all change projects.”

Timo Rüb, Vice President of valantic ERP Consulting: “The SAP Business Technology Platform can be used by companies to create the future architecture for the next five to ten years. For us as consultants, it is hard to imagine migrating to SAP S/4HANA without the BTP. The benefits and rapid return on investment we see in some of our customer projects are not yet used widely enough by companies.”

Since 2018, valantic has been asking top-class SAP experts every year about the state of affairs regarding S/4HANA migration, investment intentions, preferred technologies, and business opportunities. Again this year, almost 80 SAP experts and IT managers from German-speaking Europe participated. The online surveys were conducted in March/April of this year over a period of four weeks and IT-Onlinemagazin served as valantic’s media partner.

Download of the study results

You can download the SAP S/4HANA Study 2023 survey report here.

Source: valantic

S/4HANA Migration strategy – Brownfield and hybrid transformation approaches dominate

Source: valantic

Breakthrough for the cloud – Companies are increasingly deploying cloud offerings

Source: valantic

Process mining - 75% see process mining as a great added value, especially for process transparency