SAP DRC: Implementing e-invoices securely and efficiently

January 14, 2025

January 14, 2025

A new legal regulation came into force in Germany on January 1, 2025: Electronic invoices are mandatory for B2B transactions. Starting in 2027, almost all companies except for micro-enterprises will have to issue e-invoices. Starting in 2028, the standard will apply to all German companies – a major step toward digitalization and increasing efficiency in business transactions.

Different solutions are available for digitalizing invoice processes. For SAP customers, SAP Document and Reporting Compliance (SAP DRC) is an ideal extension to their system landscape. This tool is not only tailored to the current challenges of invoicing but also adapts to dynamic international markets and changing legal frameworks.

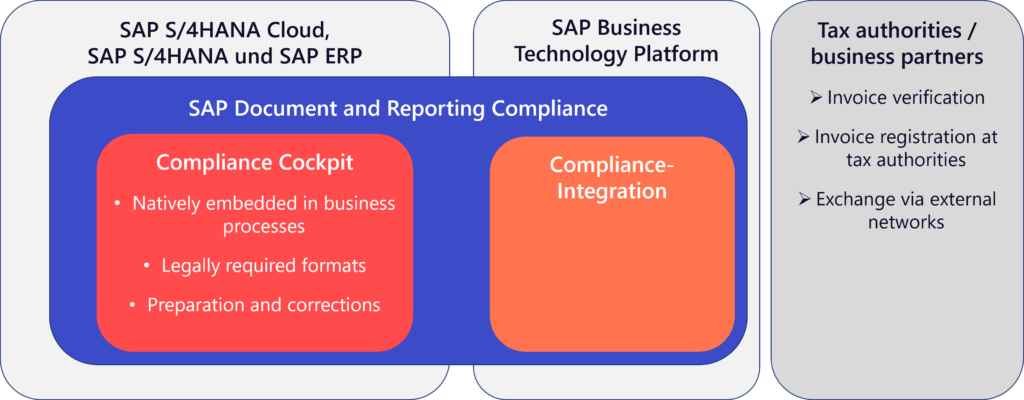

SAP DRC is also a compelling end-to-end compliance solution. It consists of two main components that work seamlessly together thanks to the Cloud Connector.

The Compliance Cockpit is implemented directly in the SAP ERP system and is centrally responsible for the creation and management of invoices in the local format. It acts as an operational interface for reviewing and editing invoice data.

At the same time, the Compliance Integration component runs on the SAP Business Technology Platform (SAP BTP) and ensures compliance with country-specific legal requirements. To do this, it transforms the locally generated invoices into the required national format.

This structure makes the compliance tool universally applicable. Companies can use it with SAP ERP as well as SAP S/4HANA on-premises and in the cloud, which ensures consistent accounting compliance regardless of the SAP architecture. SAP customers in particular benefit from this as part of an S/4HANA transformation, as they can flexibly adapt SAP DRC to their back-end environment. In this way, e-invoicing can also be consistently mapped for ongoing S/4HANA projects.

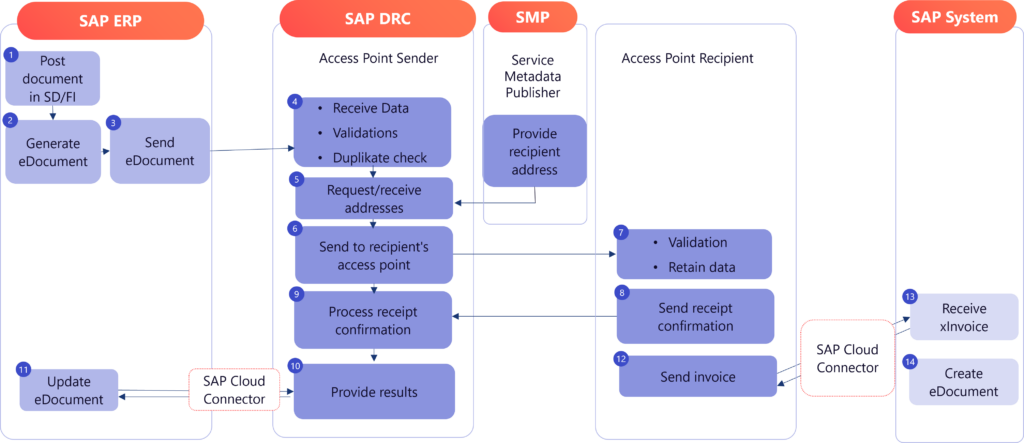

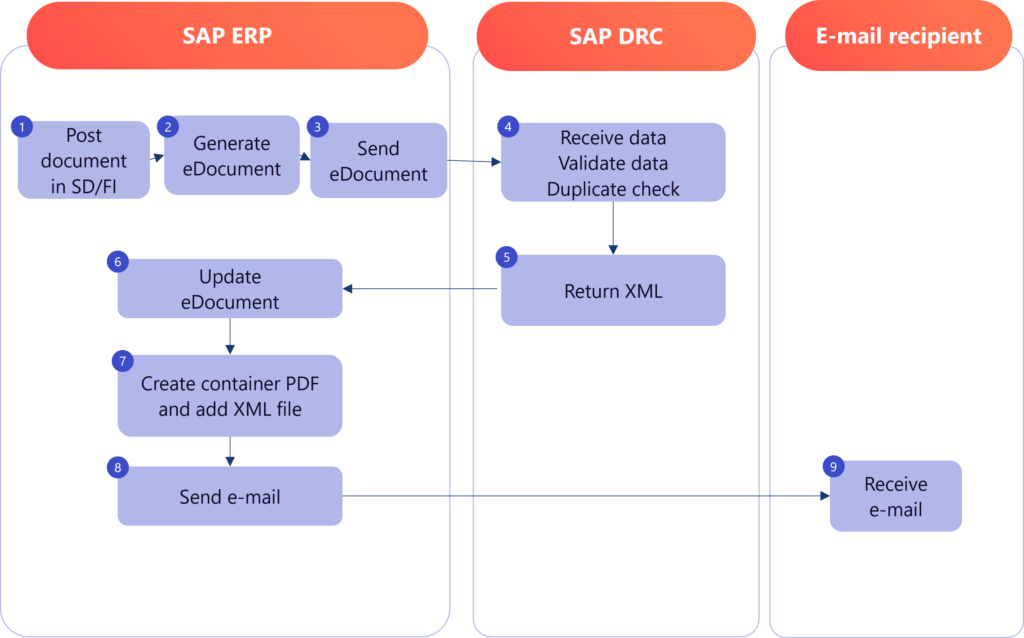

How are e-invoices generated from SAP DRC? And what role do the Pan-European Public Procurement Online (PEPPOL) network and the platform-independent country-specific data exchange format ZUGFeRD play in this process? PEPPOL enables the electronic exchange of standardized documents such as invoices, orders, and delivery notes. With ZUGFeRD, on the other hand, it is possible to embed information that can be read by both people and machines in invoices. SAP DRC supports both possibilities: Electronic transmission via PEPPOL and via e-mail in the ZUGFeRD format.

With PEPPOL, invoices generated in SAP SD or SAP FI are processed as documents as previously and simultaneously created in XML format as an electronic document in the SAP DRC Compliance Cockpit. This eDocument is sent to the Compliance Integration component of SAP BTP, which acts as a PEPPOL Access Point. That is where the validation and matching for duplicates are first performed. The recipient’s PEPPOL address is then processed and the format of the eDocument optionally adapted. After successful processing, the invoice is sent to the recipient’s PEPPOL access point and validated further. The recipient access point then sends a confirmation of receipt back to the sender and transfers the invoice to its SAP or non-SAP ERP system. The sender’s access point processes the receipt confirmation and forwards the information to the Compliance Cockpit. The status of the eDocument is updated there accordingly. SAP DRC also addresses the legal requirements for archiving.

If a file is to be sent in ZUGFeRD format, an eDocument is first created in the Compliance Cockpit. After transmission to Compliance Integration, validation, and data check, the ZUGFeRD-specific XML file is routed back to the SAP system via the Cloud Connector. There, the eDocument is updated with the necessary data and a PDF container is generated that contains the embedded XML file. Finally, the invoice is sent to the recipient by e-mail as a PDF together with an XML file. In contrast to the PEPPOL procedure, there is no exchange of receipt confirmations with ZUGFeRD.

SAP Document and Reporting Compliance not only helps German companies with electronic invoicing, but also meets international compliance requirements, including those in Italy, Mexico, and the United States. In addition, SAP DRC can be used to create and transmit legal documents in the business-to-government context (B2G) electronically, for example for the advance VAT declaration to the tax office or for the summary declaration (ZM) for deliveries in the EU internal market. For these purposes, the tool also supports international reporting requirements. All functions offered per country are available in the SAP Help Portal. SAP DRC is thus advancing not only the digitalization of invoicing, but also the transformation of reporting.

Take a step toward the future of digital invoicing with SAP DRC now! Our experts will work with you to develop custom-tailored solutions for efficient and secure e-invoicing processes.

Your contact

Noah Schiffler

Consultant in Finance at valantic

Don't miss a thing.

Subscribe to our latest blog articles.